The economy of the US is without a doubt and unquestionably dependent on the small and medium-size business. That being stated, it is fairly surprising that financing for self-employed individuals is such an issue.

There is a certain beauty to the entrepreneurial strength. You have the pride of possession in maintaining your own business. You get the chance to settle on the key choices. You get the opportunity to choose the vision for the business. Obviously, you need to pay the bills and manage down years, yet it is extremely a little cost to pay. With regards to financing, in any case, you may feel like you are being relinquished to the finance gods.

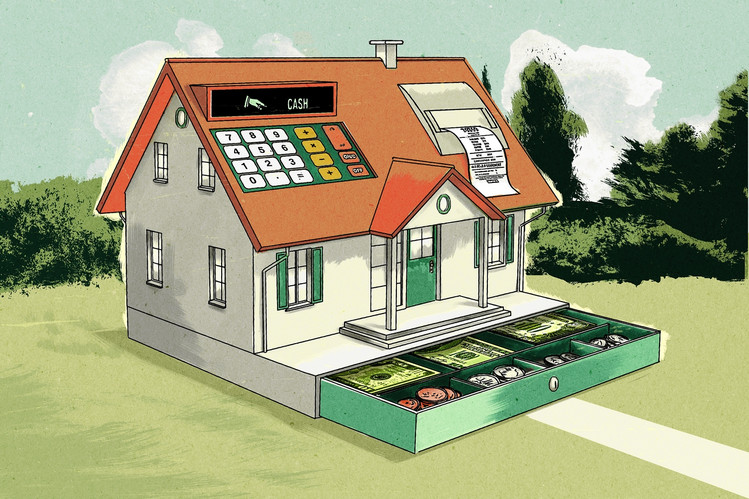

For this situation, we are talking about being self-employed and applying for a mortgage. In spite of the reality, you and I are a part of a gathering of a great many independently employed people; moneylenders don’t appear to realize how to manage us. The issue is we don’t fit in decent little squares. Owning a business is a very fluid circumstance, yet most loan lenders think about smoothness as an awful thing and are awkward with it. With an end goal to manage us, they, for the most part, need to see all of the budgetary data we have throughout the previous three years. In case you are independently employed, you realize this can prompt issues.

It is simply the uncommon day that a self-employed individual makes a steady measure of cash. Every year is unique. 2003 may have been extraordinary, while 2004 was not really. This variable salary circumstance gives home loan moneylenders significant migraines. They need to estimate whether you can manage the cost of the credit you are looking for. A major part of that estimate is the amount they figure you will make in future years and how likely it is you will make that sum. In case you had a down pay year as of late, they will frequently dismiss your credit.

Things being what they are, is there anything you can do in these circumstances? In case you have notable resources, there aren’t many exhortations I can offer you. No advantages and low pay is a terrible blend with regards to looking for financing. Then again, unique resources can give an answer.

In case you have been placing cash into the financial exchange or retirement vehicles or workmanship or whatever, there is a potential solution for your low pay issue. The appropriate response is to sell a few resources and make a greater initial installment. The exact sum is totally needy upon how much the bank requires before they will give you credit. They will, as a rule, disclose to you the amount you can get with your income figures. You have to provide the rest as the initial installment.

Working as a self-employed is extraordinary aside from when it isn’t. Applying for a home loan can be one of these unfavorable circumstances. In case you get stuck in a tough situation, consider wrenching up your initial installment to check whether it works. While you might not have any desire to sell that stock of your choice, remember you can rest in a house.

AUTHOR BIO:

Tom Hanks is a professional consultant who helps individuals to get approved for home loans by leading them in the right direction. Tom also loves to write about his experience and share with individuals related to the mortgage industry. Recently, Tom wrote about self-employed mortgage lenders in his blog to inform about the risks included in mortgages.