The 2008 crisis pushed the worldwide economy to the edge of total collapse and sent the prices of the US housing into freefall. For any individual who figured out how to cling to their employment, reserve funds, and maintained a score of their credit cards, the repercussions of the 2008 crisis can become a prime chance to purchase a house at a bargain price.

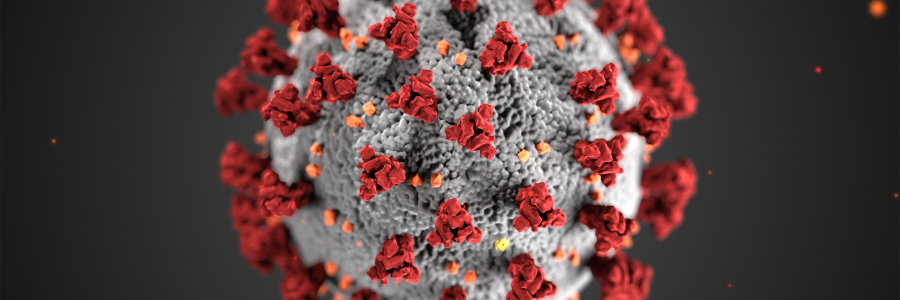

The Great Recession is the chief financial downturn millennials have survived as grown-ups, along these lines, typically, they may imagine that the subsequent downturn—which seems, by all accounts, to be not too far off due to the spread of COVID-19—will introduce an opportunity for some millennials to at long last join the positions of homeowners.

If you are looking for some solid answer to figure out whether your dream to own a home as a millennial has a possibility of flourishing amid the corona-induced recession, then stay tuned as Aleksandr Pritsker, the top realtor of NJ explains it all. Some of Aleksandr’s professional accolades include Top 10 RE/Max Realtor in NJ and Top 30 under 30. Acknowledged as Top 1% in all of NJ for three consecutive years, Pritsker has managed to become a multi-millionaire realtor at the age of 30. The millennial realtor is aware of the struggles and, thus, is the perfect mentor to explain whether the millennials got some hope or not.

The last downturn was an oddity in a more significant number of ways than one, and its impact on the housing market is the most notable anomaly comparative with different downturns. ‘What millennials fail to understand is that the 2008 downturn did not cause the housing sector to go into the abyss. The housing market going into freefall prompted the downturn,’ says Pritsker.

In the years that paved the way to that downturn, the lenders were giving home loans that were bound to fall flat. Those home loans were packaged into bonds and dispersed over the global financial framework. At the point when individuals began defaulting on those home loans, the economic structure tumbled, and a vast number of houses went into foreclosure, causing costs to fall.

Interestingly, the likely downturn because of COVID-19 will be initiated by urban cities going into lockdown, an essential step toward hindering the further spread of the infection. Organizations shutting or decreasing production—especially the airlines, café, and media ventures—has made almost 17 million Americans have been unemployed since the existence of the pandemic, causing the expected downturn to be messy for the population. Before the pandemic, the housing market heading into this spring was set to be amazingly competitive. A coronavirus-triggered recession will be depressing on the grounds that there’s so much we don’t have the foggiest idea of yet. However, researchers are comparing housing markets during past pandemics and presumed that while the volume of housing exchanges dropped drastically, costs fell just a bit, if by any stretch of the imagination.

There is A Hope for Millennials

It’s likewise significant that a downturn isn’t something to be trifled with. Since several millennials battled due to the outcome of the last downturn and have record levels of student debts, the subsequent recession could have desperate consequences for the current generation. Be that as it may, in case you’re in a position where you have investment funds, family assistance, or a job that is probably going to stay stable through a downturn, there are some potential situations wherein purchasing a home during a recession may bode well.

The down payment is frequently individuals’ most significant impediment to homeownership, so having cash set aside will consistently give you an edge over other buyers.

Moreover, the surge in unemployment will constrain some planned homebuyers to plunge into their reserve funds, successfully removing them from the home buying market until they get another line of work. This could mean less bidding wars making it possible for you to buy a home. A steady stream of income helps in deciding if you meet all requirements for a home loan, which is a lot harder today than it was before 2008. Technically, the millennial entrepreneurs and freelancers, who continue to earn even during the pandemic and lockdown will get significant benefits.

A downturn would place a strain on the demands of the housing market, which has been high as the economy has flourished. The issue is that supply despite everything stays low. It’s conceivable that a drawn-out downturn could provoke more property holders to sell or downsize, making more homes available for sale in the market. With these games of demand and supply, the millennials can surely win and get the best bargain. ‘There’s definitely hope for all the millennials out there,’ says Pritsker.

No Comments

Leave a comment Cancel